The Central body of Direct Expenses (CBDT) has unobtrusively sneaked through an explanation at a dark spot, ordering the Annual Data Proclamation (AIS) to contain all the data that the Personal Duty Division has acquired about a person.

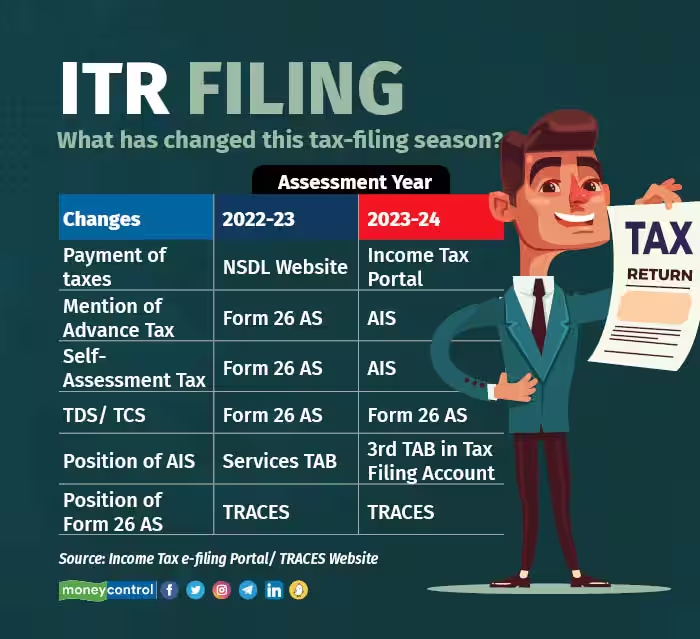

The old Structure 26 AS, which used to hold the information with respect to fixed stores (FDs), charge deducted at source (TDS), and charge installments made by an individual, has been gotten free from numerous information fields, for example, advance duty and self-evaluation charge.

A couple of days prior, the place of the AIS was moved from the administrations tab on the personal duty entrance. It is currently positioned solidly in the center as the third bar on the primary page when a citizen signs into his record.

“From AY (appraisal year) 2023-24 onwards, Yearly Expense Articulation (Structure 26 AS) … will show just TDS/TCS-related information. Different subtleties would be accessible in the AIS (Yearly Data Proclamation) at the e-recording gateway,” says a two-line note in an ordinary textual style where one downloads Structure 26 AS.

A significant change like this hasn’t been conveyed to contracted bookkeepers (CA) or bodies like the Foundation of Sanctioned Bookkeepers of India (ICAI). At the point when Moneycontrol contacted a few CAs to look for their response to these changes, they communicated help at the solidification of structures. The AIS was presented in June 2021. “For what reason should numerous reports be alluded to while documenting returns? The transition to extend the extent of AIS is great, as it would kill variety. AIS contains all the information the Personal Duty Division gets from every one of the elements. Its degree has been extended, and it is a much-nitty gritty proclamation,” says Paras Savla, Accomplice at KPB and Partners.

Extended AIS

In any case, the itemized assertion of AIS irritates quite a large number. AIS contains determined exchanges and charges paid or discounts got. This incorporates pay procured, premium on investment funds bank and FDs, property sold, stocks sold, and common asset units recovered or bought, charge card spends above Rs 10 lakh, profits, premium, lease got, unfamiliar settlements, power bills in overabundance of Rs 1 lakh, inn bills above Rs 30,000, cash removed above Rs 1 crore, and gold buys above Rs 2 lakh.

“AIS is an extended structure, and becoming mixed up in the details is simple. Frequently a similar data is shared by numerous elements and is thus tediously referenced in the AIS. For example, the common asset exchanges are informed by the asset house, enlistment center, and offer exchange specialists, like CAMS and KFin Advances,” says Chetan Chandak, Chief TaxBirbal. These twofold passages and various columns of information punched in make it challenging for people to go through AIS. Be that as it may, there is an exit plan. “There is twofold, in some cases triple revealing under AIS. However, the rundown explanation of TIS eliminates the duplication,” says Ameet Patel, Accomplice at Manohar Chowdhry and Partners. At the end of the day, when you open the AIS tab on the duty entry, you can see the synopsis proclamation as an afterthought.

Subtleties Missing

Despite the fact that the AIS contains numerous lines of data, you actually need to allude to extra archives to pull in extra subtleties that are expected to document annual government forms. Despite the fact that the TDS and pay installment subtleties are referenced in the AIS, the itemized Structure 16 would be required as the separation of compensation must be referenced in the government forms.

Additionally, the capital increases caught in the AIS each time you sell value offers may not lay out a precise picture. “The capital additions number displayed in AIS specifies the end rate for the day you sell the stock however doesn’t consider the genuine buy date or buy cost. Thus, the capital increases figures referenced can’t be utilized, and you would need to source an assertion from the stock intermediary to really record your profits,” expresses Chandak of TaxBirbal.

Data referenced, yet entirely not pre-filled

Then again, while some data is referenced in the AIS and you anticipate that it should be referenced in the pre-filled personal government forms, these fundamental subtleties aren’t maneuvered into the assessment forms.

Take, for example, the allowance for reserve funds bank revenue, which is caught under the AIS however isn’t straightforwardly pre-filled in the personal assessment form. In this way, reserve funds bank revenue of up to Rs 10,000 is accessible for charge derivation under Area 80 TTA, and senior residents can guarantee the two reserve funds bank and FD premium of up to Rs 50,000 under Segment 80 TTB.

“While this information on reserve funds bank and FD premium is caught in AIS, it isn’t pre-filled (in your annual expense form structures). The people who have not finished up this derivation at the significant spot in the duty recording structure have needed to settle charge, as interest was added to their pay and burdened according to the expense section. We have documented reconsidered returns for such people,” says Sudhir Kaushik, Prime supporter of TaxSpanner.com.

Charges paid missing

Despite the fact that the personal duty division has moved the development charge information and the self-evaluation charge information to the AIS, moneycontrol.com has met perusers who paid the responsible expenses as the self-appraisal charge on June 14, yet until June 22, 2023, it hasn’t been reflected in their AIS.

This could be on the grounds that the duties are to be paid utilizing the personal duty entrance and not the Public Protections Storehouse Restricted (NSDL) site, which was utilized until a year ago. All in all, for AY 2022-23, in the event that you needed to cover charges, you needed to go to the NSDL site. Presently, successful AY 2023-24, the duty installment window has moved to the e-recording gateway.

One would need to keep the challan distinguishing proof number protected in the event that any complaint was to be raised. Yet, since you have over a month with maybe some time to spare, it would be to your greatest advantage to stand by to record your profits on the off chance that the charges aren’t reflected in your AIS, recommend charge experts.

Patel says that both development expense and self-appraisal charge have been moved to AIS. “On the off chance that it isn’t reflected in your AIS, then stand by before you present the assessment forms. Last year, many individuals paid the self-appraisal charge on July 30 and documented returns on July 31, yet since the self-evaluation charge wasn’t being reflected in the assessment articulations and the profits were handled rapidly, they later got sees,” says Patel.

Guarantee blunder free AIS

Guarantee that the data in your AIS is right, as these subtleties will be taken care of into your pre-filled government forms. In the event of any disparities, you want to submit criticism utilizing the choice recorded in the AIS to get the subtleties remedied. A confuse of the numbers could prompt a notification.