Infra is booming. However bank loaning to framework has eased back in the beyond five months, there are signs that financiers are investigating it once more, reflected by the line of foundation bonds gave by certain moneylenders.

India’s framework story is seeing its subsequent coming and markets are as of now getting bullish with their wagers on it. Stuck projects are finding monetary culmination and organizations engaged with building India’s streets, ports, air terminals, and rails are seeing an expansion in their net revenues.

In 2022-23, new venture proposition developed by 36% to Rs 30 lakh crore. The final quarter saw a record-breaking elevated degree of new venture recommendations.

A major piece of getting the framework story right is to get its funding right. For India, framework supporting brings out a fairly upsetting memory of the past cycle that was overflowing with overextended financial plans, mis-administration, terrible obligations, lastly the breakdown of IL&FS that prompted an emergency of certainty towards non-bank finance organizations (NBFC). Somewhere in the range of 2018 and 2020, the Indian economy lost its development energy attributable to the drag from the over-utilized framework area.

Thus, it is justifiable that a string of disquiet towards infra supporting keeps on leftover even today and maybe is the justification for why asset streams to infra haven’t matched the strategy positive thinking showed by the public authority and, surprisingly, the confidential area in the earlier year. All things considered, there are signs that brokers are investigating infra loaning once more, reflected incompletely by the line of framework bonds gave by certain banks.

Depending on infra

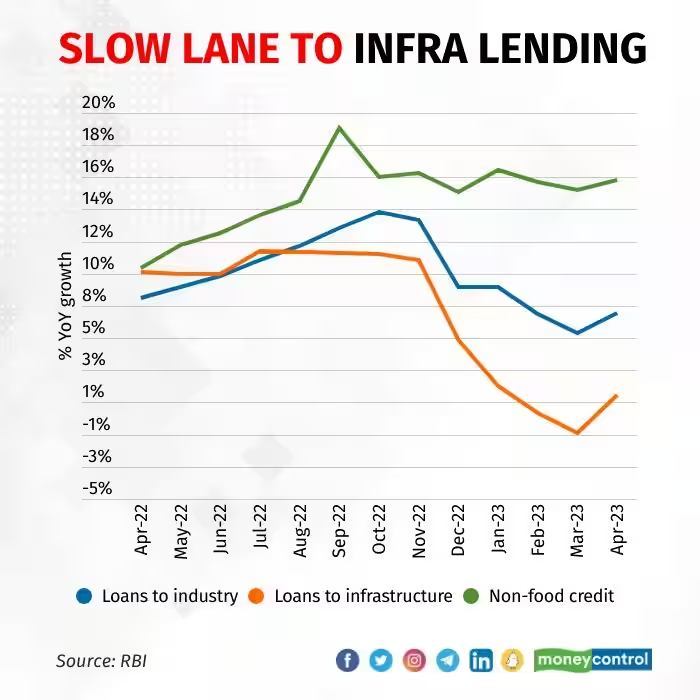

With regards to the greatest wellspring of subsidizing, banks and non-bank moneylenders, the story is blended. Bank loaning to the foundation area has eased back in the beyond five months, information from the Save Bank of India (RBI) shows. Framework credit grew a measly 1.4 percent year on year in May and contracted in April. Financiers have demonstrated that they would practice alert while loaning to foundation this time. “Foundation, chiefly streets and renewables are where the large interest is coming from, and the organizations have a better monetary record than previously. The gamble is low however there is still gamble and these are long-residency advances. It needs to meet every one of our necessities and we must be cautious about estimating,” said a chief at a public area bank mentioning secrecy.

State Bank of India (SBI), the country’s biggest moneylender that expands a major piece of infra credits, is certain of credit development however not in a rush. “We have altogether reinforced our gamble the board and we are extremely careful; we really endorse our gamble limits for every industry, and we draw from our learnings from the business what are the mitigants which are expected to be set up,” Khara said in SBI post-profit experts’ association on May 18. In ensuing media connections as well, the SBI boss sounded careful.

Brokers will back framework projects however many are liking to keep a safe distance from risk by loaning to NBFCs zeroed in on infra. Additionally, moneylenders are proactively dealing with their responsibility side by picking to give framework securities which will permit them to utilize explicit pockets of assets towards foundation. Infra bonds are long haul liabilities for banks as against stores that are generally present moment. In FY23, infra bond issuances by banks rose strongly and the volume is probably going to stay energetic this year too.

Kotak Mahindra Bank Ltd, the most moderate of loan specialists and a bank that has stayed away from infra previously, is prepared to loan now and has drifted an issue of foundation securities for the equivalent. The moneylender in its administration editorial post profit has demonstrated that it will chomp into the foundation area by expanding the portion of such credits from almost zero to 5-7 percent.

The reluctance from loan specialists doesn’t mean the infra area will be famished of assets. In contrast to in the past cycle, fresher wellsprings of assets have sprung up and intrigue from long haul annuity reserves has expanded.

New sources starting up

The Public Bank for Funding Foundation and Advancement (NABFID) has been set up to solely zero in on framework projects. NABFID as of late raised Rs 10,000 crore from the homegrown security market through a lady issue, the returns of which will utilized for loan. NABFID has an objective of Rs 1 lakh crore for FY24 and has previously dispensed Rs 15,000 crore and endorsed one more Rs 50,000 crore worth of credits.

Infra supporting has a lift with the presentation of elective venture reserves (AIF, for example, Foundation Speculation Trusts (InvITs) and Land Venture Trusts (REITs). However sent off as soon as 2014, these built up forward momentum just years after the fact, and in FY21 and FY22 the sum conveyed developed complex. For point of view, InvITs issuances added up to a little over Rs 25,000 crore in FY21, a gigantic increment from Rs 2,000 crore the first year. This energy is supposed to go on in FY24 and right now issuance of InvITs and REITs have totalled more than Rs 8,000 crore in the initial two months itself.

Vimal Nadar, Head of Exploration at Colliers India brought up that InvITs and REITs are still in the beginning stage yet their presentation is empowering. “All out reserves prepared by REITs and InvITs during April-May 2024 have previously outperformed the financing raised during the entire FY23, in this way showing that these elective subsidizing instruments are acquiring scale and acquiring bigger ground,” he said. “The development of REITs and InvITs will prepare for expanded retail support in these Foundation and land projects in India.”

What these elective sources likewise do is reuse capital by permitting designers to adapt their resources and move capital into different tasks that should be worked starting from the earliest stage. “InvITs can basically place cash in a ready venture that produces incomes. For an engineer, this implies renegotiating existing obligation and diverting capital somewhere else,” said an investigator with a worldwide rating organization mentioning obscurity.

The infra-funding story is as yet a work underway. Investors are willing again to plunge into long haul loaning towards what can called “country construct”. Luckily, banks are tracking down ways of keeping away from previous oversights and better deal with their resource risk profile. Controllers also have acquainted empowering instruments with assistance banks.

The cycle this time around may not be guaranteed to end in torment. Regardless of whether it, the injuries would be sensible and detached.