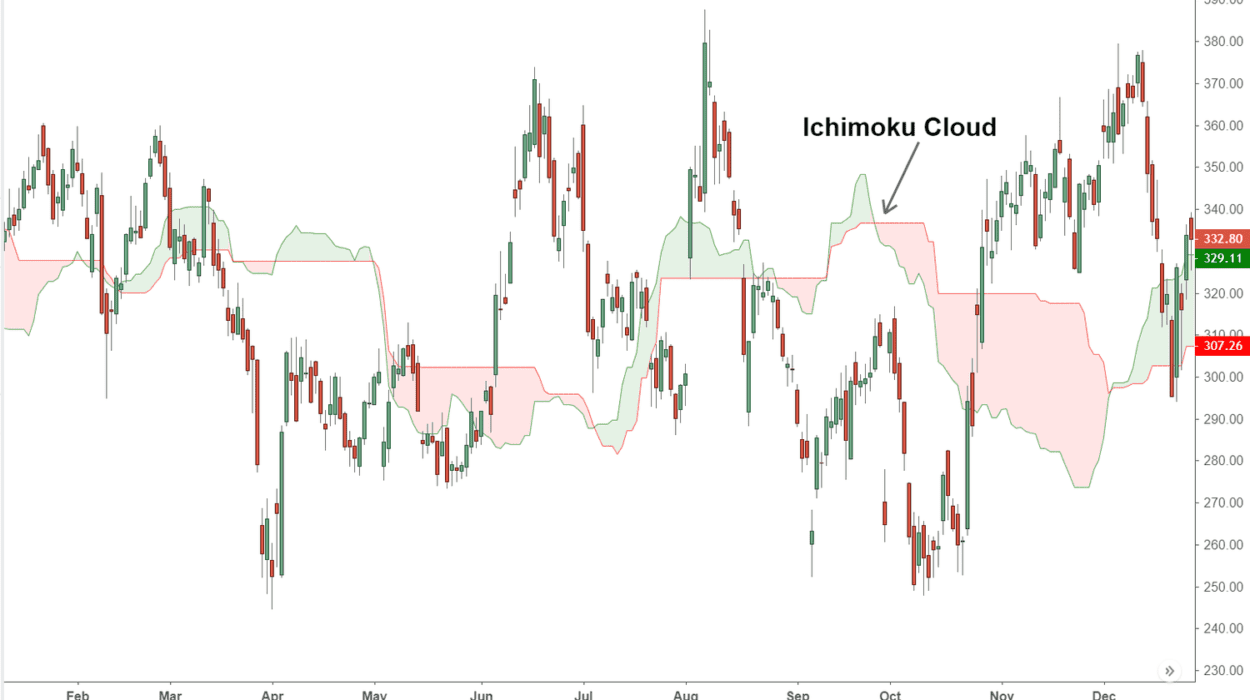

Ichimoku Cloud Trading Setup: Ichimoku Cloud, often referred to as Ichimoku Kinko Hyo, is a powerful and versatile technical analysis tool used by traders to identify potential trend direction, support and resistance levels, and entry/exit points in the financial markets. Developed by Japanese journalist Goichi Hosoda in the late 1930s, the Ichimoku Cloud has gained popularity among traders worldwide due to its holistic approach to analyzing price charts. In this article, we will explore the components of the Ichimoku Cloud trading setup and how it can be used to make informed trading decisions.

Ichimoku Cloud Trading Setup

Understanding the Ichimoku Cloud Components

The Ichimoku Cloud consists of five key components that, when combined, offer a comprehensive view of price action and market sentiment. These components are:

- Tenkan Sen (Conversion Line): The Tenkan Sen is the faster-moving line, typically calculated as the average of the highest high and lowest low over a specific period (often 9 periods). It represents short-term price momentum and helps identify potential trend reversals or changes.

- Kijun Sen (Base Line): The Kijun Sen is the slower-moving line, calculated as the average of the highest high and lowest low over a longer period (typically 26 periods). It serves as a measure of intermediate-term price momentum and is used to identify potential support and resistance levels.

- Senkou Span A (Leading Span A): Senkou Span A is one of the two cloud components, and it is calculated by taking the average of the Tenkan Sen and Kijun Sen, projected 26 periods ahead. This forms the first boundary of the cloud and is used to determine potential future support or resistance levels.

- Senkou Span B (Leading Span B): Senkou Span B is the second component of the cloud, calculated as the average of the highest high and lowest low over the past 52 periods, projected 26 periods forward. It forms the other boundary of the cloud and provides additional support and resistance levels.

- Kumo (Cloud): The Kumo represents the space between Senkou Span A and Senkou Span B. It can be thought of as a dynamic support and resistance zone. A thick cloud indicates strong support or resistance, while a thin cloud implies weaker levels.

Interpreting Ichimoku Cloud Signals

Now that we understand the components of the Ichimoku Cloud, let’s discuss how to interpret the signals generated by this trading setup:

- Bullish Signal: When the Tenkan Sen crosses above the Kijun Sen, it generates a bullish signal, indicating that short-term momentum is positive. If this crossover occurs above the cloud, it’s considered a stronger signal.

- Bearish Signal: Conversely, when the Tenkan Sen crosses below the Kijun Sen, a bearish signal is generated, suggesting that short-term momentum is negative. A crossover below the cloud is considered a more robust bearish signal.

- Confirmatory Signals: To increase the reliability of these signals, traders often look for confirmation from the cloud. If the crossover coincides with the price being above the cloud for a bullish signal or below the cloud for a bearish signal, it strengthens the likelihood of a successful trade.

- Kumo Breakout: When the price moves above the cloud (Kumo) after a bullish crossover or below the cloud following a bearish crossover, it is known as a Kumo breakout. These signals are considered strong indicators of trend direction.

- Chikou Span: The Chikou Span is the closing price plotted 26 periods back on the chart. When the Chikou Span crosses the price from below to above, it is a bullish signal. Conversely, when it crosses from above to below, it’s a bearish signal.

Conclusion

The Ichimoku Cloud trading setup is a versatile and comprehensive technical analysis tool that provides valuable insights into market trends, support and resistance levels, and potential entry and exit points. Traders often use it to confirm other technical indicators and develop well-informed trading strategies. However, like any trading method, it’s essential to combine it with risk management techniques and other forms of analysis to make effective trading decisions. With a thorough understanding of the Ichimoku Cloud’s components and signals, traders can add this tool to their trading arsenal and improve their odds of success in the financial markets.