Selecting a financial advisor is akin to charting a course through a labyrinth; it requires careful consideration and thorough evaluation. The true worth of an advisor becomes apparent over time, reflecting in the performance of your investments and the attainment of your financial objectives. With a plethora of options available in the market, embarking on this journey demands diligence and discernment.

Where to Begin:

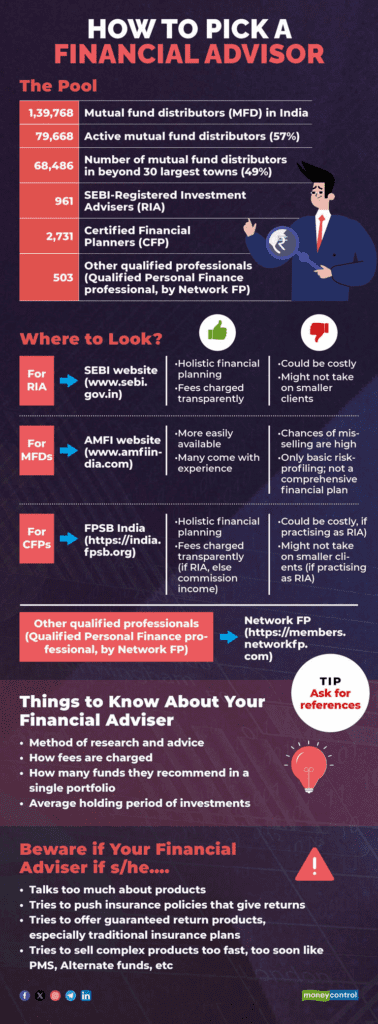

In a landscape teeming with over 1.40 lakh mutual fund distributors (MFDs) and 961 Registered Investment Advisors (RIAs), the task of identifying a suitable advisor can seem daunting. Understanding your preferences and requirements serves as a cornerstone in this process. Whether you seek comprehensive financial planning or targeted advice, aligning your expectations with the expertise of the advisor is imperative.

Choosing the Right Fit:

The spectrum of financial needs varies across different stages of life. While novices in their 20s may seek guidance on initiating investment journeys, individuals in their 30s or 50s may necessitate nuanced strategies encompassing family responsibilities and retirement planning. Assessing whether you prefer in-person consultations or virtual interactions further refines the selection criteria.

Product Pushing versus Personalization:

A pivotal aspect in discerning the efficacy of an advisor lies in their approach towards product recommendations. Advisors who prioritize product features over tailored solutions may signal a red flag. Beware of those peddling guaranteed returns or advocating complex products without considering your specific goals. The ability to listen attentively and customize recommendations distinguishes exemplary advisors from mere product pushers.

Advisor’s Qualifications and Conduct:

Scrutinizing the qualifications and conduct of the advisor offers valuable insights into their professionalism and expertise. Registered Investment Advisors (RIAs) and Certified Financial Planners (CFPs) bring a holistic perspective to financial planning, encompassing diverse facets beyond mere investments. Conversely, maintaining transparency and adhering to ethical communication practices are hallmarks of a reputable advisor.

Conclusion:

In an era characterized by evolving financial landscapes and burgeoning aspirations, the role of a proficient financial advisor assumes paramount importance. Whether navigating the intricacies of investment avenues or safeguarding against market volatilities, the guidance of a trusted advisor can pave the way towards financial prosperity. By exercising due diligence and discernment, individuals can embark on a journey of informed decision-making and prudent wealth management.