In a significant development, overseas funds have propelled the Indian stock markets, nearing the coveted $50 billion mark in gross purchases of Indian stocks. This surge comes on the back of attractive valuations of large-cap shares and positive re-rating prospects post the Lok Sabha polls.

Record-Breaking Figures

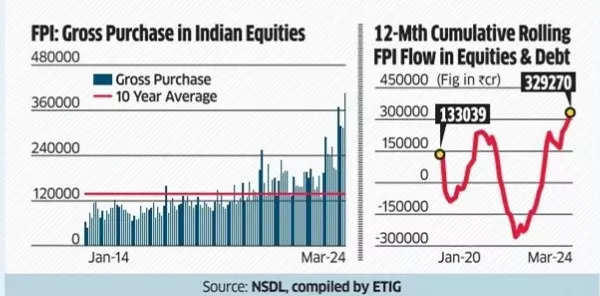

Foreign institutional investors (FIIs) have set a new benchmark with Rs 4.06 lakh crore ($49 billion) in gross purchases recorded in March, marking the first instance of crossing the Rs 4 lakh crore mark in a month. This surge, nearly 1.65 times higher than the last one-year average, underscores the sustained momentum with gross purchases exceeding Rs 3 lakh crore for the fourth consecutive month, as per an ET analysis.

Net Inflow Boosts Market Confidence

Resultantly, there was a net inflow of Rs 35,098 crore ($4.2 billion) in equities for India, propelling the 12-month cumulative equity inflow to a 32-month high of Rs 2.08 lakh crore ($25 billion). Notably, in the first half of March alone, FPIs injected a rare net inflow of $4.9 billion, according to NSDL data.

Domestic vs. Overseas Investments

In contrast, domestic funds invested Rs 1.8 lakh crore in equities over the previous 12 months up to February 2024. The shift in valuation approach from CAPE to PEG for Indian equities by investors has played a crucial role in attracting foreign investments.

Undervaluation Highlighted

A recent CLSA report emphasized India’s undervaluation concerning its earnings potential. The PEG ratio, which evaluates the 12-month trailing PE divided by annualized 24-month EPS growth, indicates India is trading at 1.4x compared to the historical average of 1.8x. FPIs managed assets worth $756 billion as of the first half of March, reflecting a 42% increase year-on-year.

Balancing Domestic and Foreign Inflows

Despite the surge in foreign investments, domestic inflows have remained robust, leading to a gradual decline in the foreign share of India’s total market cap from its peak of around 24-25%.