Your credit score is more than just a number. It’s a powerful indicator of your financial health and can significantly impact your ability to secure loans, mortgages, credit cards, and even employment. Whether you’re a first-time homebuyer or a seasoned investor, understanding Credit Score Optimization Tools is crucial. In this article, we’ll explore credit score optimization tools, their benefits, and how they can empower you to take control of your financial future.

What Is a Credit Score?

Before diving into optimization tools, let’s briefly review what a credit score is. A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850 (FICO score). The higher your score, the better your credit profile. Lenders use credit scores to assess the risk of lending money to you. Factors that influence your credit score include payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries.

Why Optimize Your Credit Score?

A higher credit score opens doors to better financial opportunities:

- Lower Interest Rates: A good credit score qualifies you for lower interest rates on loans and credit cards. This translates to significant savings over time.

- Easier Loan Approvals: Lenders are more likely to approve your loan applications when your credit score is strong.

- Higher Credit Limits: A better credit score allows you to access higher credit limits, giving you more financial flexibility.

- Employment Prospects: Some employers check credit scores during the hiring process. A positive credit history can enhance your employability.

Credit Score Optimization Tools

1. CreditXpert® Suite

The CreditXpert® Suite offers a range of tools designed to help mortgage professionals assist their clients. Here are some key features:

- Credit Assure™: Automatically scans credit files and identifies potential score improvements. It provides real-time insights to help applicants make informed decisions.

- Credit Radar™: Provides a credit report cover page with forecasted mid-scores. It helps identify critical issues before reviewing the full credit report.

- CreditXpert® Wayfinder™: An analysis tool that guides applicants toward optimal credit scores. It generates personalized plans to improve creditworthiness.

2. Xactus Scoring Tools

Xactus’ Scoring Tools empower mortgage professionals to qualify more consumers. Here’s what they offer:

- Detailed Credit Score Analysis: Quickly analyze applicants’ credit scores and identify areas for improvement.

- What-If Simulator: Experiment with changes to credit files (e.g., applying for credit, making payments) to predict resulting scores.

- Expert Credit Consulting: Beyond automated tools, Xactus provides expert credit consulting. Their experienced credit experts create customized strategies for successful rescoring.

3. Credit Optimizer

Credit Optimizer by easyfinancial combines calculators, personalized recommendations, and access to your full credit report. It empowers you to make informed decisions and take control of your financial future.

Best Practices for Credit Score Optimization

- Pay Bills on Time: Timely payments positively impact your credit score.

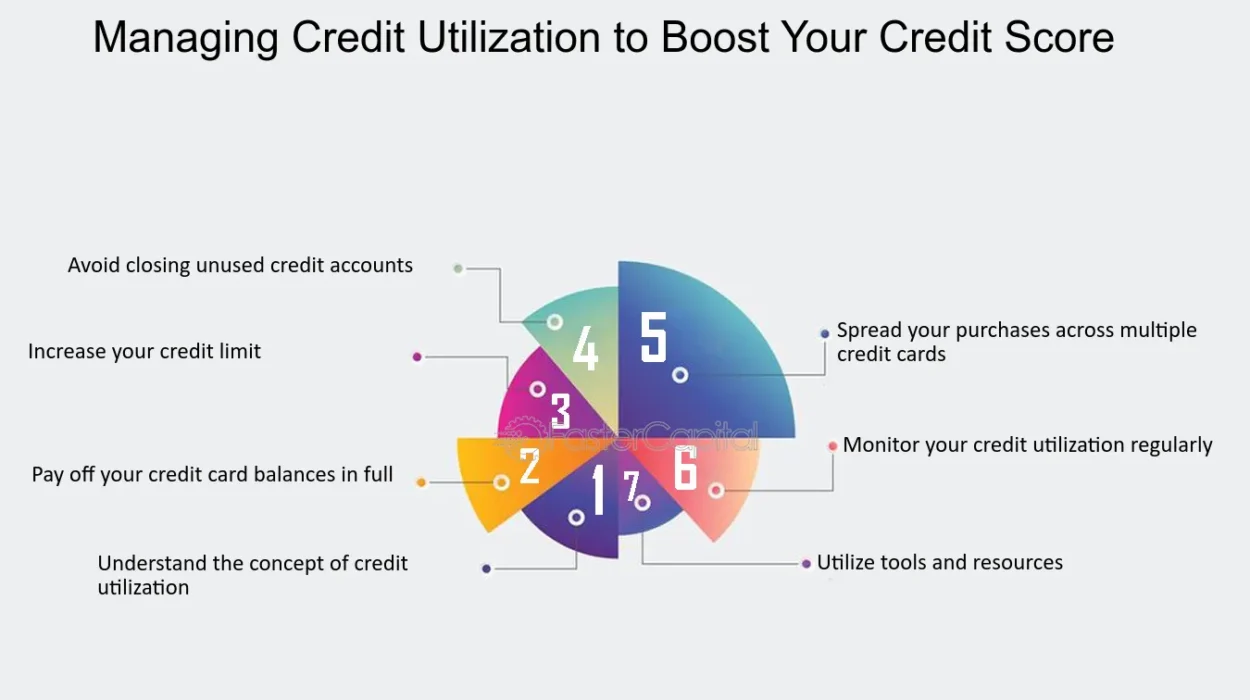

- Reduce Credit Utilization: Aim for a utilization rate below 30% of your available credit.

- Diversify Credit Types: A mix of credit cards, loans, and mortgages demonstrates responsible credit management.

- Monitor Your Credit: Regularly review your credit reports for errors or inaccuracies.

Conclusion

Credit score optimization tools are essential for anyone aiming to improve their financial standing. Whether you’re a borrower, lender, or financial advisor, leveraging these tools can lead to better credit scores, lower interest rates, and increased financial opportunities. Remember, a well-optimized credit score isn’t just a number—it’s a gateway to financial success.

Now, armed with knowledge and the right tools, take charge of your credit journey and unlock a brighter financial future! 🌟